by Kirsten Mowrey

Si quaeris peninsulam amoenam circumspice.” If you grew up here, this probably sounds familiar. For the transplants, this is Michigan’s state motto: “If you seek a pleasant peninsula, look about you.” Yet life has not been so pleasant economically on this peninsula in recent decades.

Angela Barbash knows about financial challenges. Of Mexican and Italian descent, she’s the first generation not to work on a migrant farm, but grew up in a poor neighborhood in Westland. Now a wife and mom herself, Barbash recognizes the intimidation of learning financial management. At her Ypsilanti - based company Revalue, Barbash educates and empowers people to change their lives and their communities through ethical, local, micro-investing. She worked on the MILE (Michigan Invests Locally Exemption) Act, presents at socially responsible investing conferences, and is preparing to host a national conference on community capital in Detroit in June 2019.

Kirsten Mowrey: Last year was a huge year. You were listed in Crain’s Detroit Business as one of the Notable Women in Finance in May, and Revalue created the online Holistic Financial Kit.

Angela Barbash: Yes, the Holistic Financial Kit is a web course that is a good foundation [at] $179. We’re trying to get lower price point tools into the market. We need to be a part of the solution and not just serving people who have always had access. We took five years to figure out what the market we’re trying to serve wants and how we can serve them most efficiently. We’re doing things that investment firms just don’t do, like serving non-accredited investors.

Kirsten Mowrey: What’s a non-accredited investor?

Angela Barbash: In the 1930s the federal government split all of its citizens into two categories: accredited investors and non-accredited investors. If you have more than a million dollars in net worth, not including your home, or you make more than $200,000 a year in annual income or more than $300,000 a year in joint annual income, you are an accredited investor. If you are under those limits, you are non-accredited. They’ve never changed those limits, in almost 90 years. This lack of change has resulted in 94% of Americans being non-accredited.

Where this makes a difference is that prior to the state law changing, if you were non-accredited and I did not have a personal relationship with you, as an entrepreneur I could not approach you to invest in my business. Which also means that as a non-accredited investor, you did not have access to wealth building opportunities in your own community or even other investment opportunities. Those opportunities would be for accredited investors only.

Kirsten Mowrey: So, say my mom passes and I inherit $50,000. That amount would be seen as too small, and I can’t do anything to turn it into more through conventional means.

Angela Barbash: You could invest in the public markets. However, after 2008, everyone was like: “Well, is that really the least risky thing we could be doing with our money? Because I just lost half of it.” That was what really caused all of this [local investing] to start to bubble to the surface. I feel, if I’m going to lose half of it, I’d rather lose half of it in my own backyard, with people I know, and then at least that money went to feed people in my community.

KM: What do you do at Revalue, when someone comes in for advising?

AB: It starts with the traditional thing, because that’s where people usually are, that’s what they understand. But sometimes even that is new for them, sometimes they’ve never worked with an advisor or done the regular planning.

KM: I have an SEP IRA with Vanguard. If I came to you guys, what would my choices be?

AB: You could keep doing the low cost index fund thing at Vanguard, which is cheap and okay, but not necessarily values aligned.

The conventional way to approach portfolio construction is through asset allocation. Not until the late 1980s did people start to realize their money held power. It started with South Africa and [the anti-] apartheid movement. Now it has turned into things they want to support versus things they don’t want to support: clean energy, environmental stewardship, good labor practices, whatever the values of the client are. This change in investment attitude is reflected in the companies that mutual funds and index funds now invest in.

KM: Investing local is now the next step?

AB: Yes, and the next step is now you, Kirsten. Say you care specifically about GLBTQ. We will find companies that specifically support or are run by people that are in that demographic. That kind of granularity is brand new, that’s just within the last five years, and local is one of those values. That’s how this became part of our core work; when you start talking about helping people really align with their values at that kind of granularity, then local comes with it because people care about their local economy very much.

KM: They want to know they are funding someplace like Cultivate. [Cultivate Coffee and Tap House in Ypsilanti].

AB: Yes. There are studies done by the BALLE network [Business Alliance of Local Living Economies—Paul Saginaw of Zingerman’s is a past board member] over the last decade that showed what happens to a dollar that’s spent locally and how many times it circulates in the community. A dollar spent at a local company circulates into five to ten dollars versus a national company where only 40-60 cents circulates back [into the community]. That study was further support for local being a value and values-driven investing is that kind of one-to-one matching.

KM: How does this feed into community capital and the Comcap event in Detroit in June?

AB: Community capital is the process of individual non-accredited investors directly investing locally in their community. Now’s the time to give [people] the tools they need to have a real seat at the table. That’s what has led to Comcap being in Detroit. [June 11-13, 2019 at the College for Creative Studies. Learn more at www.comcap.us].

This is the basis of economic gardening. Kirsten, we have $65 trillion dollars of wealth in this country. Less than 1/10th of 1% is invested in privately held, community-based businesses. Even if we shifted only another 1% into our communities, we start talking about distributed power through economic democracy.

KM: So the woman who wants to open a store in my neighborhood, I can now invest in her store.

AB: Right. The problem was the Jobs Act [which changed the federal laws around who can raise capital and who can invest in those capital raises] passed unanimously, and then the SEC was tasked with writing the rules. But they did not write the rules for four years, so activists in individual states [stepped in]. In Michigan it was a handful of activists in Adrian. They linked up with a student team from UM School of Public Policy and me. We got a legislator on board. The activists said, “Look, there’s an exemption on the books already that we’re just not exploiting because we’ve never written rules around it. We just need to pass a law, or make an administrative rule change or some mechanism that puts rules in place that says if you as a company want to use this exemption, this is what you have to do to use it.”

KM: That’s the MILE (Michigan Invests Locally Exemption) Act?

AB: Yes. When I got up and testified for the commerce committee hearing about the MILE Act in Lansing, generally the whole committee was in support of it, but there was one legislator who was a financial advisor. She was [saying] “Grandma’s gonna get swindled”—that attitude is always the challenge. I said the way to keep Grandma from getting swindled was not to remove freedom and access, but to increase education. Education is the solution to your concern. If we don’t educate, then yes, there are going to be some mistakes. So support this, and then support education to come after it. It’s taken us five years, but education is now going to come to the state. Michigan Main Street Investor Education events began in December 2018.

Revalue is a Certified B Corporation (a business that meets the highest standards of verified social and environmental performance, public transparency, and legal accountability to balance profit and purpose) located in Ypsilanti, MI. You can contact them by calling 888-642-2728, or visiting them online at www.revalueinvesting.com.

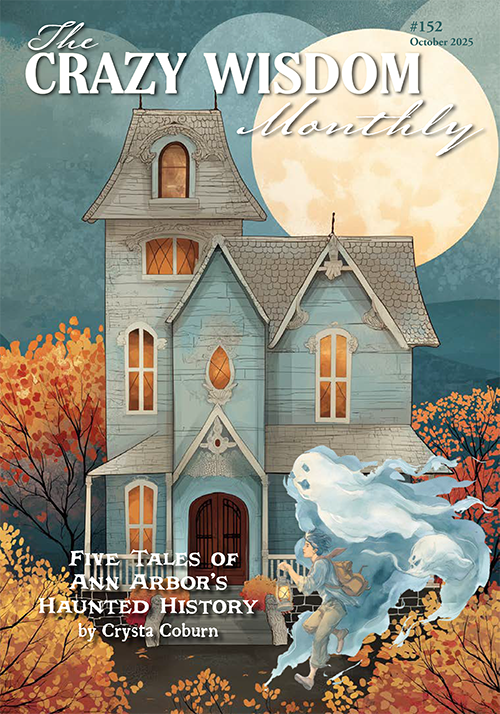

The city of Ann Arbor has been around for over 200 years. That’s more than enough time for tales of the paranormal to manifest. Probably the most famous local spirit is that of Martha Crawford Mulholland, a.k.a. the Dixboro ghost, who is believed to haunt the Dixboro General Store. But she is far from the only ghost story Ann Arbor has to tell.